February 11, 2018 (THE FERO REPORT)

The Fero Report used Spooler to recreate this thread by Tuur Demeester. We found it worthy for putting into article form for helping us and the Fero Report’s esteemed readers think about blockchain and cryptocurrency investing. Thanks, Tuur, for this educational rant!

The most important takeaway we saw was that superior code and product trump savvy marketing for a long haul investment every day of the week and twice on Sunday. Oh, and the market prices we see today are in all likelihood irrational, or don’t fully reflect the value of all information about given projects.

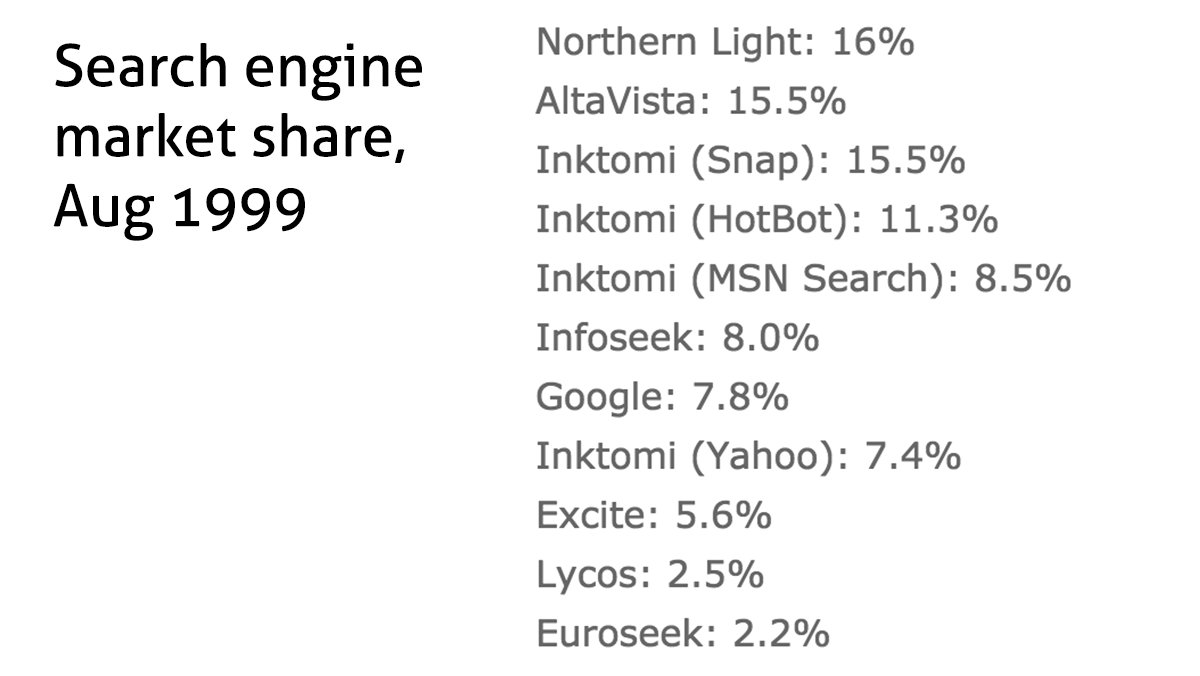

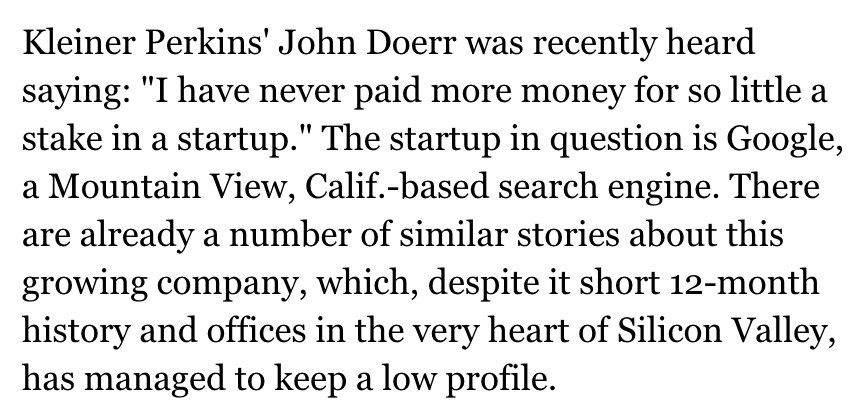

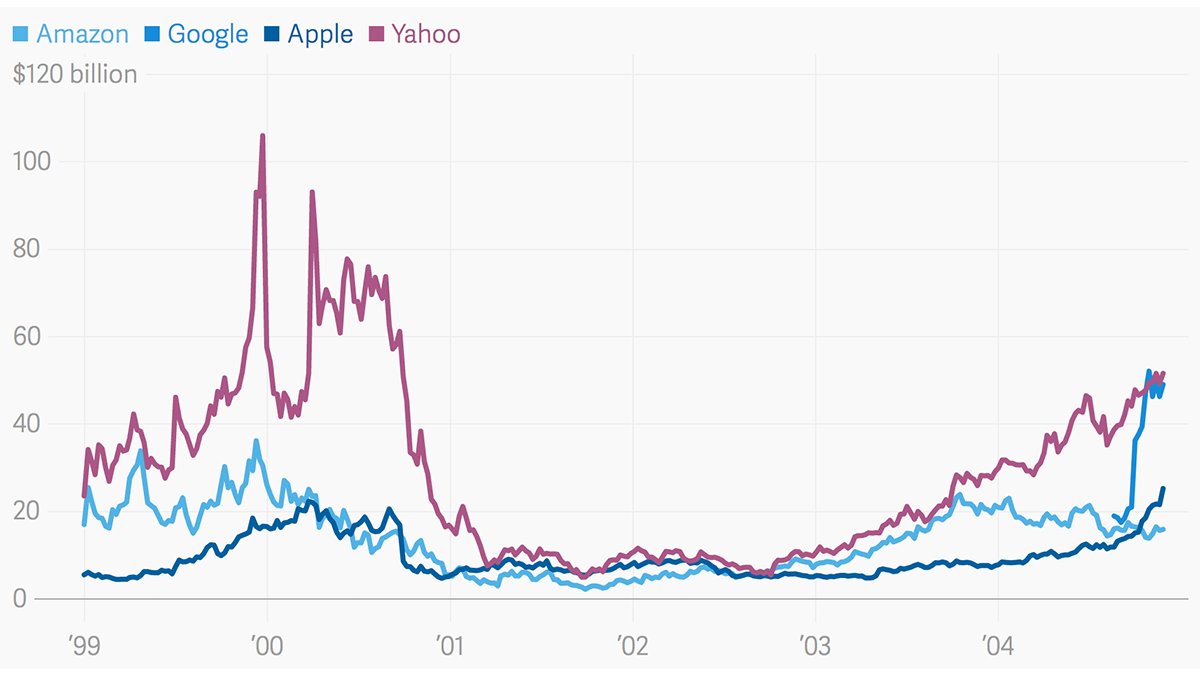

The DotCom bubble shows that the market isn’t very good at valuing early stage technology. I’ll use Google vs. Yahoo to illustrate. In 1999, Google already had more search engine market share than Yahoo, yet the market valued it at a measly 0.15% that of Yahoo. ($125M vs. $80B).

And Google’s market share growth wasn’t a coincidence: insiders knew very well that its search engine technology was far superior than the competition. (forbes.com/1999/10/04/fea…)

Yahoo’s approach to search in 1999 was absolutely unsustainable, as it clearly would not scale. (edition.cnn.com/TECH/computing…)

Still, many held on to the belief that search technology “untouched by human hands” would remain unreliable. (theregister.co.uk/1999/10/08/yah…)

As search engines were struggling with scaling and were all bad in different ways, experts believed that the solution was to have a multitude of engines. (edition.cnn.com/TECH/computing…)

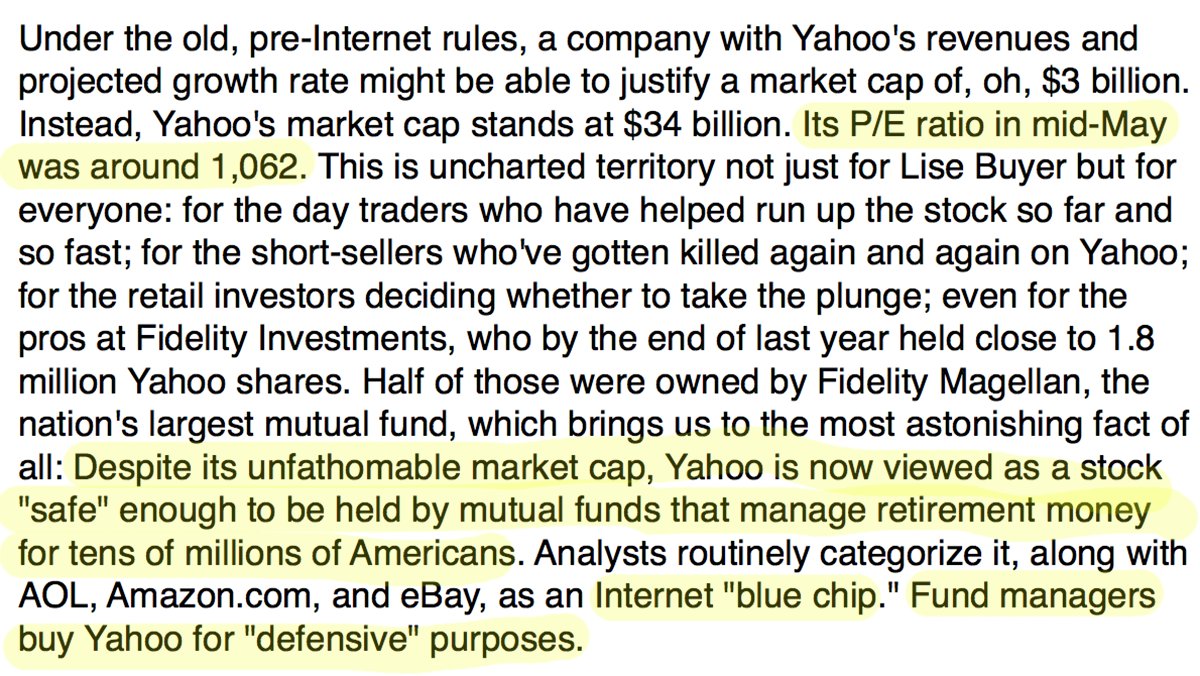

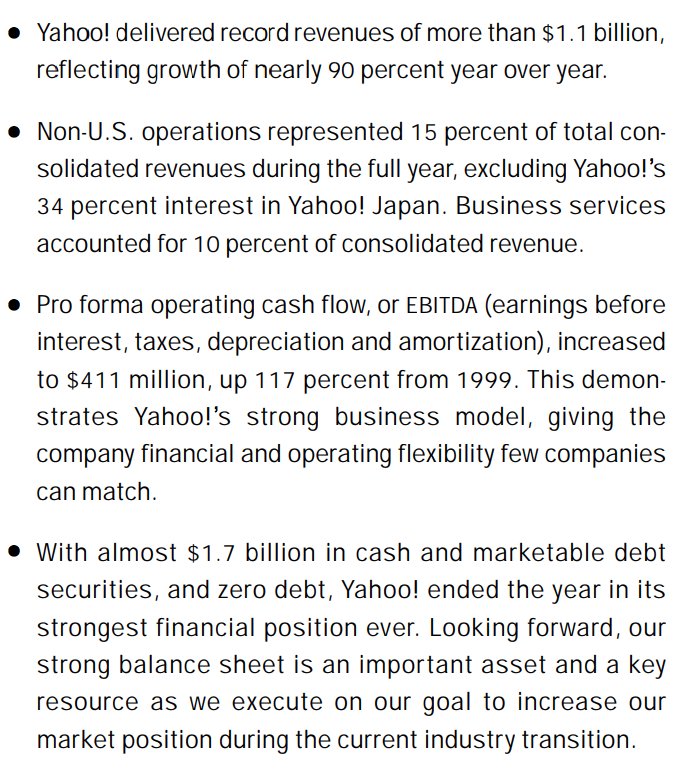

So why did the market value Yahoo at a 600x higher market cap than Google? A major reason was that it was one of the few dotcoms that was printing money: in 2001 it reported $1.1B in revenue, $1.7B in cash, no debt. Google had zero revenue. (annualreports.com/HostedData/Ann…)

So when institutions felt FOMO and gave their managers the order to “invest in the internet”, most flocked to Yahoo because of its revenues and healthy financial balance sheet.

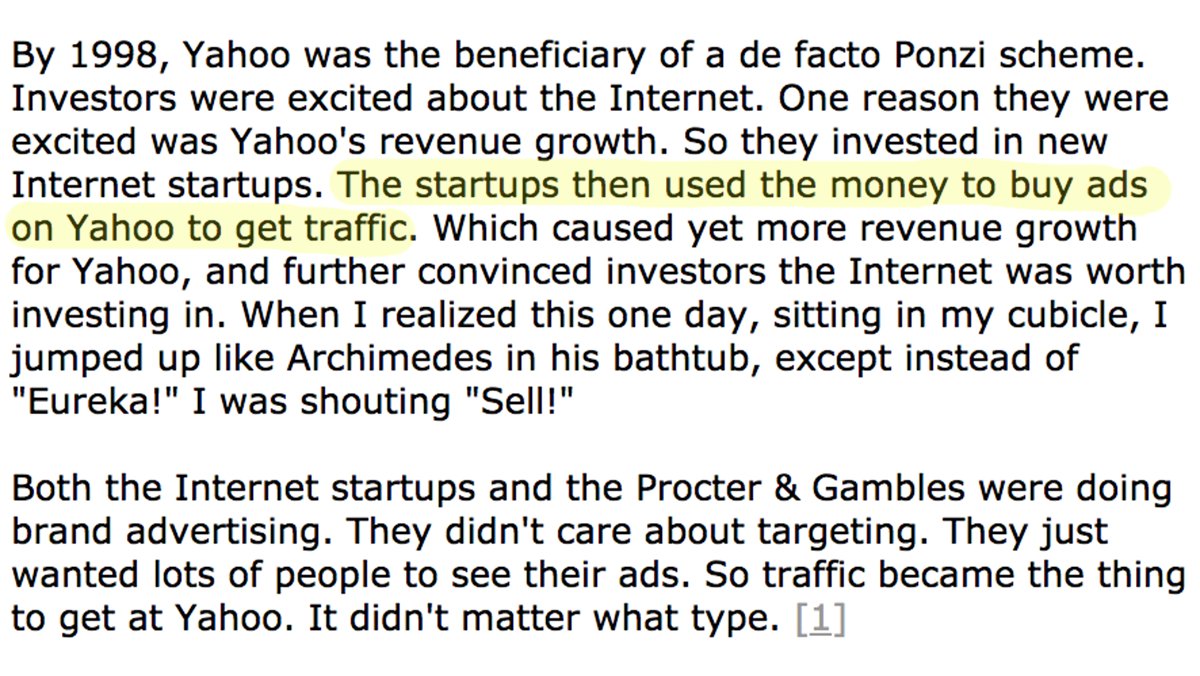

However, the market didn’t appreciate that the revenue stream came maintly from massively overvalued dotcom startups spending their advertising budgets on quickly antiquating human curated portal websites. (paulgraham.com/yahoo.html)

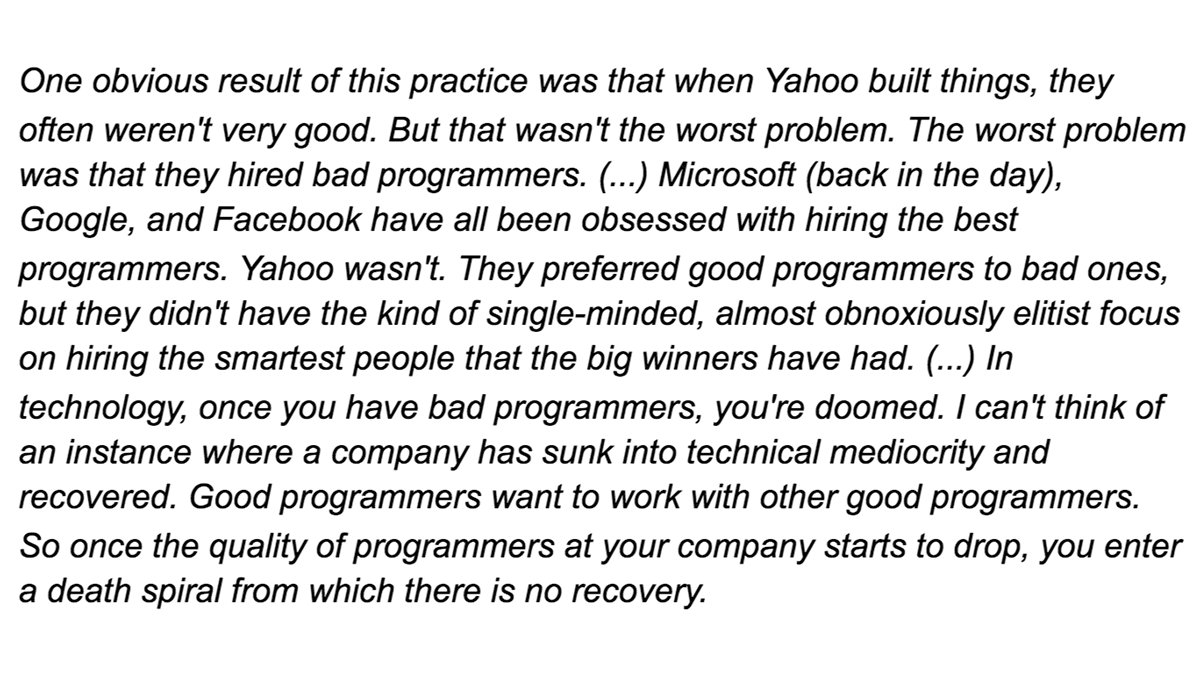

The market also didn’t appreciate that Yahoo had low standards for hiring programmers compared to Google & Microsoft, and that this would over time create an inferior browsing experience and dwindling market share.

My takeaways on tech revolution investing:

– best engineering teams generate the most value

– cash cow startups: continuity of earnings is highly non-obvious

– hype & PR is meaningless

– sometimes hard to access to best investments (google was private)